Financial Equality for Africa’s Women Farmers

Sub-Saharan

Africa remains one of the world’s most gender-unequal regions, a place where

perceptions, attitudes, and traditional roles conspire to limit women’s access

to healthcare, education, and economic resources. To overcome these obstacles,

women need greater access to financial services and farm-related credit.

Africa remains one of the world’s most gender-unequal regions, a place where

perceptions, attitudes, and traditional roles conspire to limit women’s access

to healthcare, education, and economic resources. To overcome these obstacles,

women need greater access to financial services and farm-related credit.

|

|

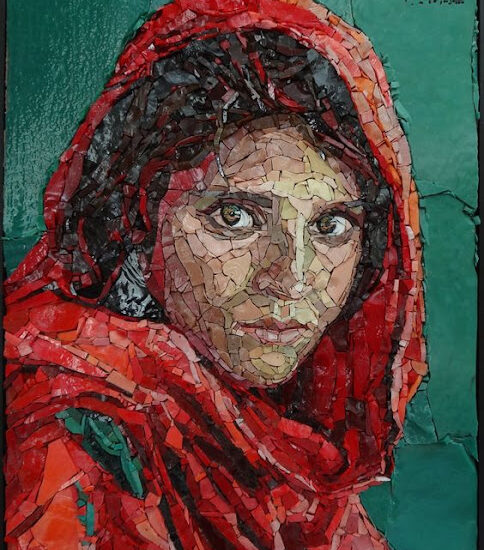

JOHN

WESSELS/AFP/Getty Images |

NAIROBI –

Around the world, social movements like #MeToo and #TimesUp are inspiring important

conversations about the inequitable practices women have long faced in every

aspect of their lives. In some cases, these discussions have led to measurable

changes in how women are treated on the job, at home, and elsewhere

in society.

Around the world, social movements like #MeToo and #TimesUp are inspiring important

conversations about the inequitable practices women have long faced in every

aspect of their lives. In some cases, these discussions have led to measurable

changes in how women are treated on the job, at home, and elsewhere

in society.

Unfortunately,

most of the focus to date has been on women in the West, or those living in

urban areas. Rural women, and particularly poor female farmers in Sub-Saharan

Africa, have not yet benefited from the recent focus on gender equality. But if

Africa’s gender gap is ever to be closed, the unique obstacles that African

women confront must become part of the global dialogue.

most of the focus to date has been on women in the West, or those living in

urban areas. Rural women, and particularly poor female farmers in Sub-Saharan

Africa, have not yet benefited from the recent focus on gender equality. But if

Africa’s gender gap is ever to be closed, the unique obstacles that African

women confront must become part of the global dialogue.

Sub-Saharan

Africa is among the world’s most

gender-unequal regions. According to the United Nations Development

Programme (UNDP), “perceptions,

attitudes, and historic gender roles” limit women’s access to health

care and education, and lead to disproportionate levels of family

responsibility, job segregation, and sexual violence.

Africa is among the world’s most

gender-unequal regions. According to the United Nations Development

Programme (UNDP), “perceptions,

attitudes, and historic gender roles” limit women’s access to health

care and education, and lead to disproportionate levels of family

responsibility, job segregation, and sexual violence.

But

perhaps the biggest obstacle to gender equality in Sub-Saharan Africa is money;

simply put, women have less of it. According to the World Bank, 37% of women

in the region have a bank account, compared to 48% of men. And, while the

percentages are low for both sexes, what is troubling is that the gap has

widened over the past several years, even as total financing

available to the world’s poor has increased

steadily.

perhaps the biggest obstacle to gender equality in Sub-Saharan Africa is money;

simply put, women have less of it. According to the World Bank, 37% of women

in the region have a bank account, compared to 48% of men. And, while the

percentages are low for both sexes, what is troubling is that the gap has

widened over the past several years, even as total financing

available to the world’s poor has increased

steadily.

Today,

women dominate African agriculture, the continent’s most important

industry. But this has not translated into greater control of

finances. One measure of this deficiency is rates of borrowing; in East Africa,

where my organization works, women borrow 13% less money for farm-related

activities than men do. Illiteracy, limited land ownership, and restrictions on

agency and mobility all conspire to reduce rural women’s access to farm

financing.

women dominate African agriculture, the continent’s most important

industry. But this has not translated into greater control of

finances. One measure of this deficiency is rates of borrowing; in East Africa,

where my organization works, women borrow 13% less money for farm-related

activities than men do. Illiteracy, limited land ownership, and restrictions on

agency and mobility all conspire to reduce rural women’s access to farm

financing.

These

barriers have had a dramatic impact on social and economic progress. For

starters, the lack of capital makes it difficult for women to buy quality seeds

and fertilizer, or even to access farmland, which in turn reduces agricultural

productivity. Crop yields in the region lag far

behind global averages, in part because women are unable to invest

enough in their operations.

barriers have had a dramatic impact on social and economic progress. For

starters, the lack of capital makes it difficult for women to buy quality seeds

and fertilizer, or even to access farmland, which in turn reduces agricultural

productivity. Crop yields in the region lag far

behind global averages, in part because women are unable to invest

enough in their operations.

Gender

inequality is also costly on a macro level. The UNDP estimates that failure to

integrate women into national economies costs the countries of Sub-Saharan

Africa a combined $95 billion

in lost productivity every year. When women living in poverty are

unable to work or contribute socially, growth stagnates.

inequality is also costly on a macro level. The UNDP estimates that failure to

integrate women into national economies costs the countries of Sub-Saharan

Africa a combined $95 billion

in lost productivity every year. When women living in poverty are

unable to work or contribute socially, growth stagnates.

On the

other hand, when women farmers have access to financing, the benefits go far

beyond the fields. Financial empowerment has been proven to increase

female participation in community decision-making. Moreover, women’s

financial inclusion helps combat social marginalization and improves

family wellbeing; when mothers have a degree of control over

household finances, their children are less likely to die from malnutrition and

more likely to thrive.

other hand, when women farmers have access to financing, the benefits go far

beyond the fields. Financial empowerment has been proven to increase

female participation in community decision-making. Moreover, women’s

financial inclusion helps combat social marginalization and improves

family wellbeing; when mothers have a degree of control over

household finances, their children are less likely to die from malnutrition and

more likely to thrive.

Given

these benefits, the question is not whether women in rural Africa need expanded

access to farm-related capital, but rather how to provide it. One solution is

to craft programs that consider disparities in education and mobility when

awarding loans. Accounting for social discrimination is essential if girls and

women are to benefit fully from available financing. Another option is to build

on successful mediation

efforts that help women discuss financial inclusion with their

husbands.

these benefits, the question is not whether women in rural Africa need expanded

access to farm-related capital, but rather how to provide it. One solution is

to craft programs that consider disparities in education and mobility when

awarding loans. Accounting for social discrimination is essential if girls and

women are to benefit fully from available financing. Another option is to build

on successful mediation

efforts that help women discuss financial inclusion with their

husbands.

But one

of the most important changes would be committed leadership by financial

institutions. If banks and lending services offered products that met the needs

of women, more women would have access to financial resources. For example,

banks could devise specific loan programs for crops that are traditionally grown by

female farmers – such as groundnuts or sunflowers. Financial

institutions could also encourage female leadership in farmers’ cooperatives,

and support markets where women sell their harvests.

of the most important changes would be committed leadership by financial

institutions. If banks and lending services offered products that met the needs

of women, more women would have access to financial resources. For example,

banks could devise specific loan programs for crops that are traditionally grown by

female farmers – such as groundnuts or sunflowers. Financial

institutions could also encourage female leadership in farmers’ cooperatives,

and support markets where women sell their harvests.

At

current rates of financial inclusion, it will take the world more than 200

years to achieve

gender parity. That is unacceptable. Progress toward women’s

empowerment does not have to be that slow. If governments, international

actors, and the financial industry make a concerted effort to devise and

sustain more gender-focused policies, it won’t be.

current rates of financial inclusion, it will take the world more than 200

years to achieve

gender parity. That is unacceptable. Progress toward women’s

empowerment does not have to be that slow. If governments, international

actors, and the financial industry make a concerted effort to devise and

sustain more gender-focused policies, it won’t be.