Climate and the Money Trail

|

| F. William Engdahl 04/10/2019 |

Climate. Now who wudda thought.

The very mega-corporations and mega-billionaires behind the globalization of the world economy over recent decades, whose pursuit of shareholder value and cost reduction who have wreaked so much damage to our environment both in the industrial world and in the under-developed economies of Africa, Asia, Latin America, are the leading backers of the “grass roots” decarbonization movement from Sweden to Germany to the USA and beyond. Is it pangs of guilty conscience, or could it be a deeper agenda of the financialization of the very air we breathe and more ?

Whatever one may believe about the dangers of CO2 and risks of global warming creating a global catastrophe of 1.5 to 2 degree Celsius average temperature rise in the next roughly 12 years, it is worth noting who is promoting the current flood of propaganda and climate activism.

Green Finance

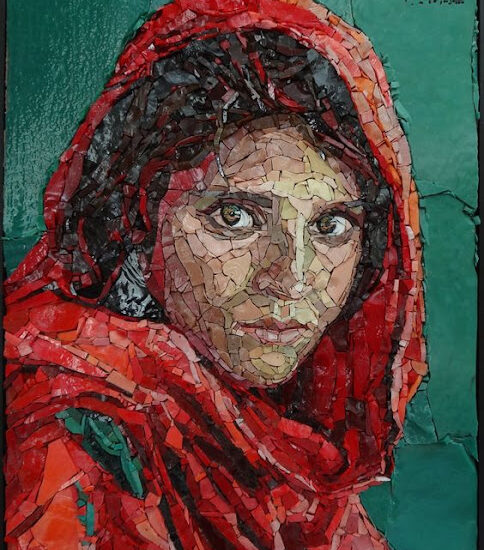

Several years before Al Gore and others decided to use a young Swedish school girl to be the poster child for climate action urgency, or in the USA the call of Alexandria Ocasio-Cortez for a complete reorganization of the economy around a Green New Deal, the giants of finance began devising schemes for steering hundreds of billions of future funds to investments in often worthless “climate” companies.

In 2013 after years of careful preparation, a Swedish real estate company, Vasakronan, issued the first corporate “Green Bond.” They were followed by others including Apple, SNCF and the major French bank Credit Agricole. In November 2013 Elon Musk’s problem-riddled Tesla Energy issued the first solar asset-backed security. Today according to something called the Climate Bonds Initiative, more than $500 billion in such Green Bonds are outstanding. The creators of the bond idea state their aim is to win over a major share of the $45 trillion of assets under management globally which have made nominal commitment to invest in “climate friendly” projects.

Bonnie Prince Charles, future UK Monarch, along with the Bank of England and City of London finance have promoted “green financial instruments,” led by Green Bonds, to redirect pension plans and mutual funds towards green projects. A key player in the linking of world financial institutions with the Green Agenda is outgoing Bank of England head Mark Carney. In December 2015, the Bank for International Settlements’ Financial Stability Board (FSB), chaired then by Carney, created the Task Force on Climate-related Financial Disclosure (TCFD), to advise “investors, lenders and insurance about climate related risks.” That was certainly a bizarre focus for world central bankers.

In 2016 the TCFD along with the City of London Corporation and the UK Government initiated the Green Finance Initiative, aiming to channel trillions of dollars to “green” investments. The central bankers of the FSB nominated 31 people to form the TCFD. Chaired by billionaire Michael Bloomberg of the financial wire, it includes key people from JP MorganChase; from BlackRock–one of the world’s biggest asset managers with almost $7 trillion; Barclays Bank; HSBC, the London-Hong Kong bank repeatedly fined for laundering drug and other black funds; Swiss Re, the world’s second largest reinsurance; China’s ICBC bank; Tata Steel, ENI oil, Dow Chemical, mining giant BHP Billington and David Blood of Al Gore’s Generation Investment LLC. In effect it seems the foxes are writing the rules for the new Green Hen House.

Bank of England’s Carney was also a key actor in efforts to make the City of London into the financial center of global Green Finance. The outgoing UK Chancellor of the Exchequer, Philip Hammond, in July 2019 released a White Paper, “Green Finance Strategy: Transforming Finance for a Greener Future.” The paper states, “One of the most influential initiatives to emerge is the Financial Stability Board’s private sector Task Force on Climate-related Financial Disclosures (TCFD), supported by Mark Carney and chaired by Michael Bloomberg. This has been endorsed by institutions representing $118 trillion of assets globally.” There seems to be a plan here. The plan is the financialization of the entire world economy using fear of an end of world scenario to reach arbitrary aims such as “net-zero greenhouse gas emissions.”