War on the toilet paper front in times of pan(dem)ics : Russia’s tissue battles Swedes, Turks, USAmericans

|

| John Helmer 24/03/2020 |

Russian toilet paper is a national secret – not a state secret, but a commercial one.

This is because production, sales and profits have been growing fast – and this has been for the past five years, before the current toilet paper panic.

Secrecy is also in operation because the major foreign companies would like to keep the lion’s share of the Russian market boom by out-selling or buying up the competing Russian toilet paper companies. They, in their turn, want to push the foreigners out by consolidating among themselves and lobbying for government measures to do that. Consolidation of assets and market share is what western market analysts call it. In Russia it can be called asset raiding. This is when one toilet paper company takes over a rival at a price for the assets which is below the real asset value.

In the bum boom, on the hot seat at the moment are Essity, a unit of SCA, the Swedish paper and pulp group group, which is currently the Russian market leader with a third of the market; Hayat Kimya, a Turkish group trying to expand from its base in Tatarstan; and Kimberly-Clark, the Kleenex maker of the US, which is losing market share to the Russian brands. SCA and Kimberly-Clark are stock exchange-listed shareholding companies with public reporting and accounting obligations. The Hayat holding is privately held. About their Russian business they are as secretive as each other. Altogether, the Russians produce just over half the toilet paper sold in the market; the Swedes, Turks and Americans, just under half. That proportion is about to change.

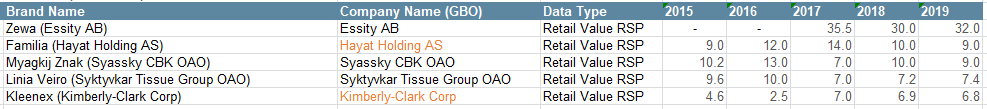

The five leading toilet paper brands in Russia are regularly surveyed and reported by Euromonitor International, the international market survey group. The most recent report, Tissue and Hygiene in Russia, was published in March 2019. Click to obtain a copy [2]. The following table includes the most recent data for 2019.

THE TOP FIVE RUSSIAN TOILET BRANDS, THEIR OWNERS AND MARKET SHARES, 2015-2019

For enlarged image click to print

Source: https://blog.euromonitor.com/ [3]